- Nuclear Update

- Posts

- ⚛️Cameco: The Backbone of the Western Fuel Cycle

⚛️Cameco: The Backbone of the Western Fuel Cycle

A deep dive into the uranium developer that’s building while everyone else dilutes.

Welcome to Nuclear Update!

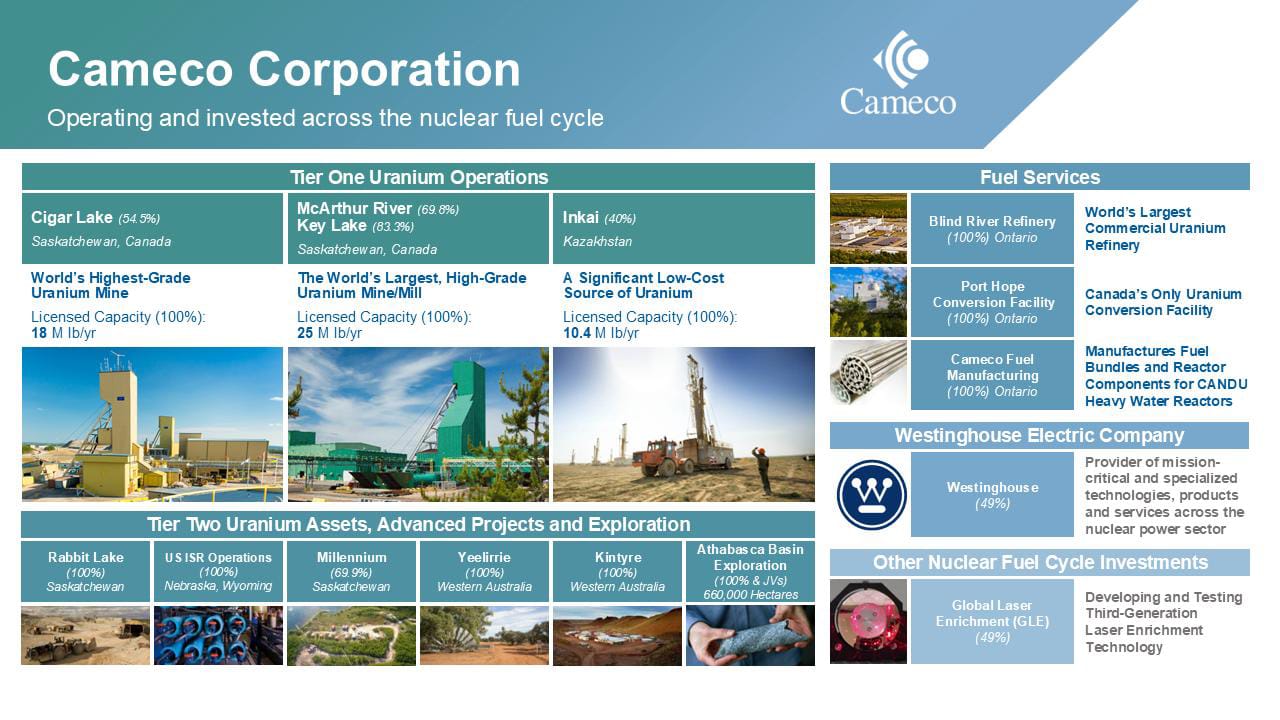

Today we’re taking a closer look at the company that sits at the center of the entire Western nuclear ecosystem: Cameco Corporation (NYSE: CCJ, TSX: CCO).

This analysis is based on official Cameco Investor Presentations and MD&As, which together outline how the company has evolved from a disciplined uranium producer into a fully integrated fuel-cycle leader. You can find the latest presentations here.

If NexGen and Denison Mines represent the next wave of uranium producers, Cameco represents the foundation they all rely on. With the largest high-grade resource base in the West, vertically integrated fuel services, and a 49% stake in Westinghouse, Cameco has become the backbone of the nuclear buildout now underway globally.

For investors, Cameco is the anchor stock of a sector that is no longer cyclical in the old sense. The story is structural, and the moat is wide.

If you want more deep dives like this, plus our live portfolio (holdings, % allocations, average entry prices), weekly “where are we in the cycle” indicators, macro commentary, insider transactions, and more, join Nuclear Update Premium HERE

Strategic Evolution

Cameco has lived through every boom and bust the uranium market has offered, and the scars shaped its strategy. After the 2007 collapse, management refused to chase volume or speculate on spot rebounds. Instead, they rebuilt the company around three simple ideas: contract discipline, operational excellence, and financial strength.

That focus turned Cameco into the most dependable supplier in the nuclear world. The company now produces from a portfolio of tier-one assets including McArthur River, Cigar Lake, Key Lake, and the Inkai joint venture in Kazakhstan, together capable of supplying more than 30 million pounds a year (on a 100% basis). Production scales up or down only when the contract book justifies it, not when the market gets noisy.

Roughly 28 million pounds per year are locked into long-term agreements through 2029, many with spot market-linked pricing that rises with the uranium cycle but includes price floors that preserve margins if the market softens. The result is a revenue stream that remains stable in downturns and expands with the cycle.

Cameco’s second advantage lies in its balance sheet. With a Baa2 credit rating, over $2 billion in available liquidity, and modest leverage, the company can finance growth without dilution or high-cost debt. That financial flexibility allowed it to buy into Westinghouse, securing a 49% stake in the firm that builds and services reactors around the world. Through Westinghouse, Cameco now earns direct exposure to the engineering and services side of nuclear, an industry segment that converts the renaissance into real cash flow today.

Together, these pieces form a business model that is part miner, part industrial platform. Cameco no longer depends on spot prices or market timing. It supplies the material, converts it, fabricates the fuel, and now builds and helps operate the reactors that consume it.

Mining Operations: Tier-One and Built to Last

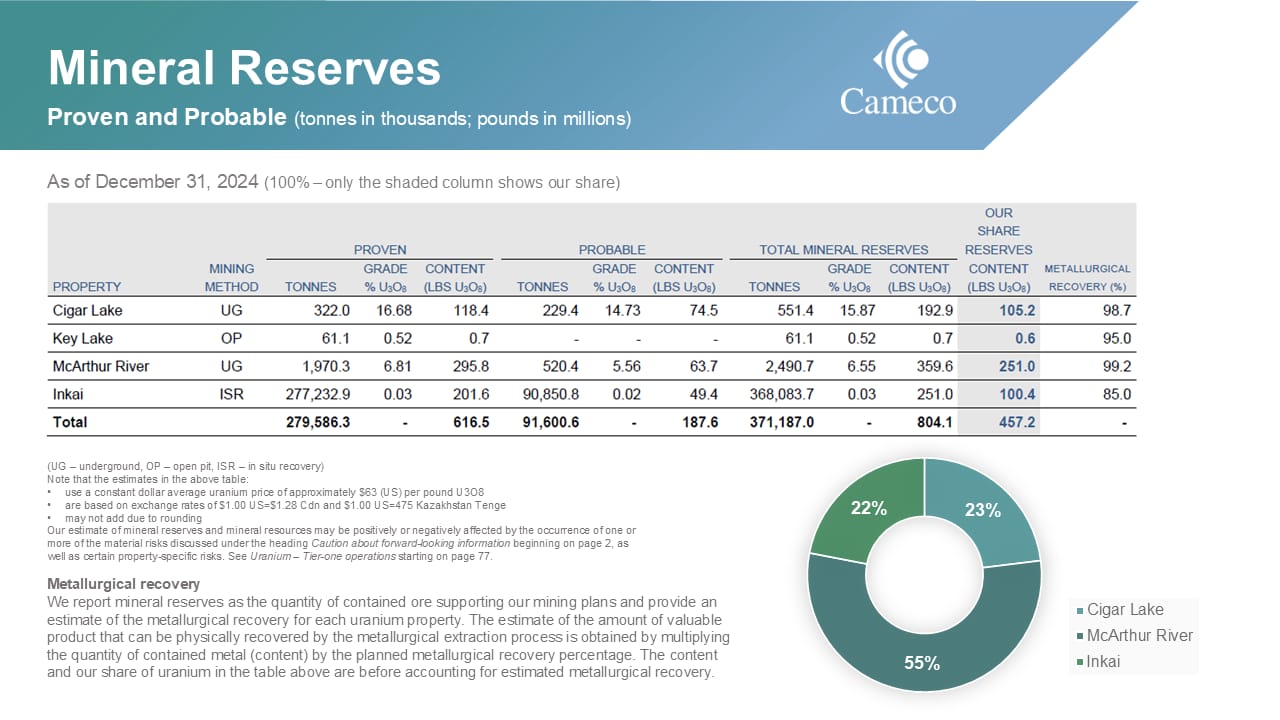

Cameco’s foundation has always been its mines. The company sits atop some of the highest-grade uranium deposits in the world, concentrated in northern Saskatchewan’s Athabasca Basin and complemented by its joint venture in Kazakhstan. Together, these assets provide a unique balance of grade, jurisdictional safety, and scalability.

McArthur River and Key Lake: The Power Pair

The McArthur River mine and Key Lake mill form the backbone of Cameco’s Canadian production base. McArthur River holds one of the richest ore bodies ever discovered, averaging grades more than 100 times higher than most global deposits. That concentration translates into efficiency: fewer tonnes moved per pound produced, lower operating costs, and a built-in environmental advantage.

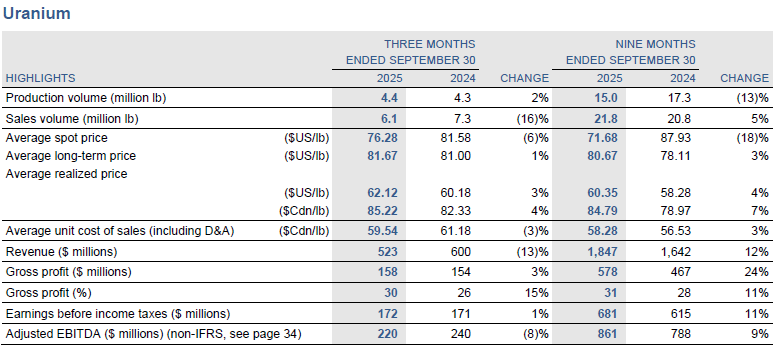

Financially, this complex is Cameco’s crown jewel. In Q3 2025, the uranium segment delivered C$220 million in adjusted EBITDA, with McArthur River and Key Lake providing the lion’s share, even as quarterly results were shaped by lower sales volume and delivery timing. Beyond Canada, these assets act as a global benchmark for Western supply, a reference point for pricing and reliability that few producers can match.

Operational Snapshot (Q3 2025):

Annual production (100% basis): 14–15 Mlbs U₃O₈

Cameco ownership: 70% (McArthur), 83% (Key Lake)

Cash operating cost: C$20.31/lb

Average realized price: ~US$60/lb (market-linked contracts)

Operating margin: 55–60%

Target run rate: 18 Mlbs/year (100%)

Mine life: 20+ years

Recent capital investment: C$150M in restart and modernization

After several years on care and maintenance, McArthur River and Key Lake were restarted in late 2022 and ramped through 2024. The 2025 guidance trimmed volumes slightly due to underground sequencing delays, but the company emphasized that the issue was temporary. Margins remain robust, and the operation continues to generate hundreds of millions in quarterly cash flow.

The deposit itself continues to grow. Drilling and resource modeling at the northern and eastern extensions have confirmed additional high-grade zones, adding longevity to an already world-class reserve base. Proven and probable reserves stands at roughly 251 million pounds of U₃O₈,. McArthur River is expanding its runway!

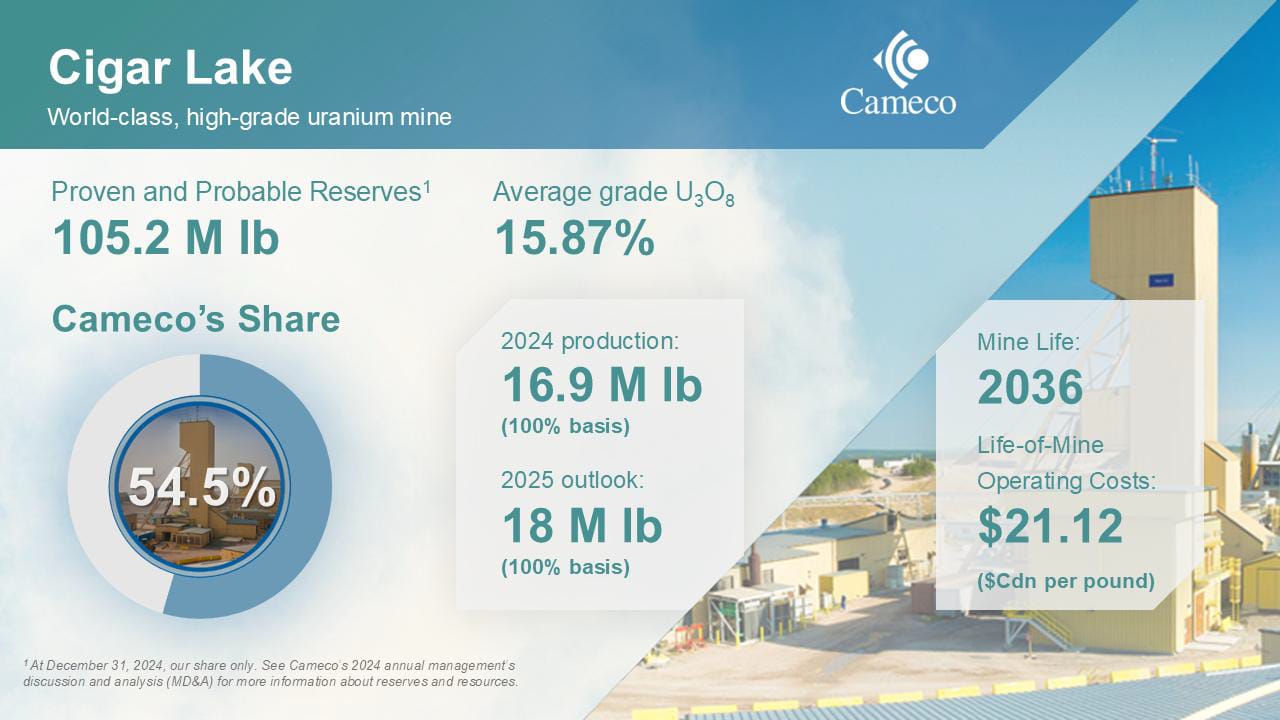

Cigar Lake: The Proven Workhorse

If McArthur River and Key Lake are Cameco’s power pair, Cigar Lake is the steady workhorse. Operated by Orano with Cameco holding a 54.5% interest, Cigar Lake has produced more than 105 million pounds since 2014 and remains one of the largest and highest-grade uranium mines in the world.

Operational Snapshot (Q3 2025):

Annual production (100% basis): 18 Mlbs U₃O₈

Cameco ownership: 54.5%

Average grade: 15.87% U₃O₈

Recovery rate: >98%

Operating cost: C$21.12/lb

Average realized price: ~US$60/lb

Mine life: 10+ years

Processing: McClean Lake mill (more on this below)

Despite over a decade of mining, Cigar Lake’s story is far from finished. Continued drilling along the east and west flanks of the deposit has extended mineralization and outlined new high-grade zones. The 2024 reserve and resource statement listed ~105 million pounds of remaining reserves at grades averaging 15%, with additional inferred material offering further upside.

The Cigar Lake–McClean Lake combination provides a fully licensed, low-cost processing chain through at least 2027. It’s a powerful advantage: many juniors still don’t have an answer for where their ore will go, while Cameco’s path to market is fully integrated, from mine to mill.

For investors, Cigar Lake plays two roles. It generates stable cash flow quarter after quarter, and it anchors Cameco’s position as the most experienced operator in the Athabasca Basin. When the sector talks about “tier-one assets,” this is what they mean.

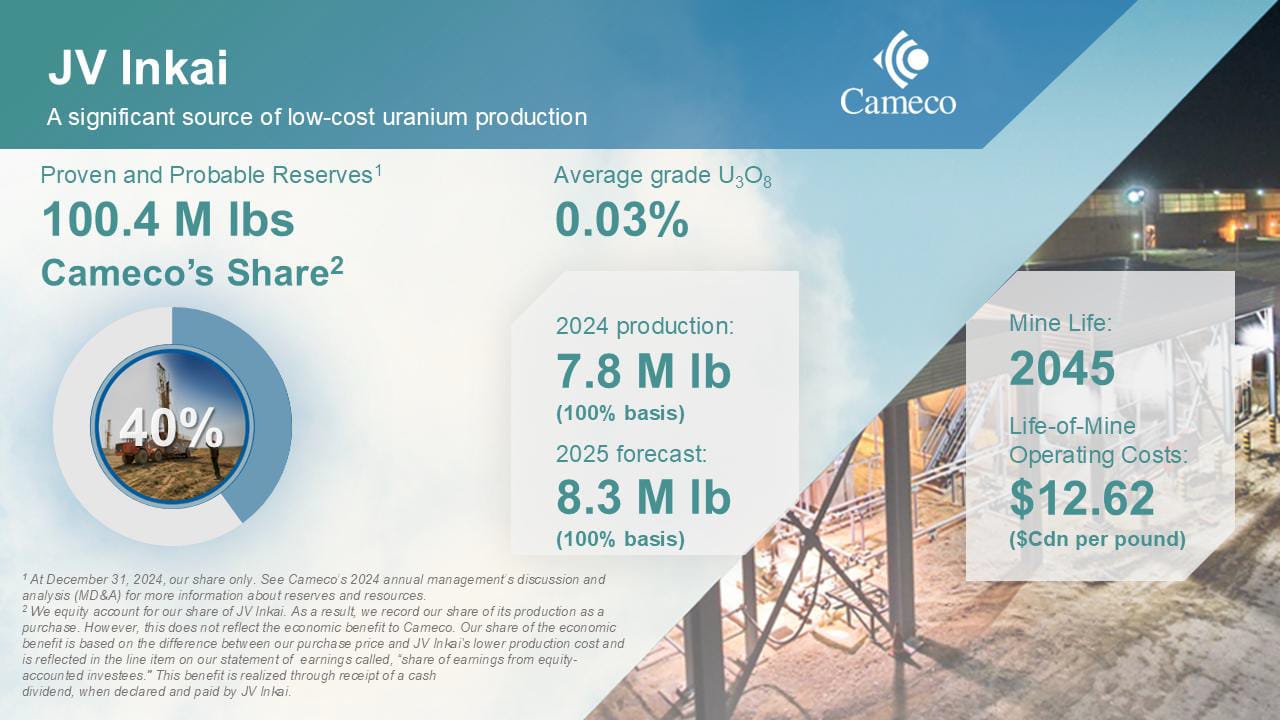

Inkai: The Strategic Link

Cameco’s footprint extends beyond Canada through its Inkai Joint Venture in southern Kazakhstan, a partnership that bridges Western and global uranium supply. Cameco owns 40% of Inkai, with Kazatomprom holding 60%.

Operational Snapshot (Q3 2025):

Annual production (100% basis): ~8.3 Mlbs U₃O₈

Cameco share: 3.3 Mlbs

Mining method: In-situ recovery (ISR)

Operating cost: C$12.62/lb

Average realized price: ~US$55/lb

Transport: Trans-Caspian route (fully operational since 2024)

Mine life: 20+ years

Inkai remains one of the lowest-cost uranium producers globally, for Cameco, it isn’t just a cost-efficient asset; it’s a strategic bridge to the world’s largest uranium producer (Kazatomprom). It ensures geopolitical diversification, and steady margins that smooth earnings when Western production fluctuates.

McClean Lake and Exploration Pipeline

Beyond its core producing assets, Cameco holds a 22.5% interest in the McClean Lake Joint Venture, operated by Orano and Denison Mines. The site includes one of Canada’s only licensed uranium mills and a series of near-surface deposits now being redeveloped using Orano’s SABRE (Surface Access Borehole Resource Extraction) method.

The JV resumed mining at McClean North in mid-2025, yielding roughly 800,000 pounds (100% basis) in its first campaign.

For Cameco, the financial contribution is modest, but the strategic significance is high: it validates next-generation extraction techniques that could unlock smaller satellite deposits across the Basin.

The mill itself provides vital processing capacity for Cigar Lake and ensures Cameco remains embedded in the regional uranium ecosystem.

Cameco’s broader Athabasca Basin exploration portfolio spans more than 660,000 hectares, including wholly owned and joint venture interests, across highly prospective ground concentrated along the eastern corridor that hosts McArthur River, Key Lake, and Cigar Lake.

Activity is concentrated around Millennium and Fox Lake, alongside 100% Cameco-owned ground at Cree Extension and Waterbury, all within trucking distance of existing infrastructure.

Millennium remains one of the most advanced undeveloped deposits in the Basin, with inferred resources of roughly 104 million pounds at 3.76% U₃O₈ (Cameco 70%, Orano 30%). Though on the back burner since prices collapsed in 2016, the project remains a shovel-ready optionality play for future cycles.

Fox Lake, discovered in 2015 through deep basement drilling near McArthur River, contains 68 million pounds at 7.99% U₃O₈ (Cameco 42.3%), and continues to see follow-up exploration aimed at expanding the envelope northward.

Cree Extension and Waterbury projects remain under evaluation for ISR potential, leveraging learnings from both Inkai and Denison’s Phoenix pilot program.

When uranium prices rise or utilities start pressing for multi-decade supply contracts, these dormant assets can move fast because the permits, data, and drill networks already exist.

Outside the Basin, Cameco maintains early-stage exploration ground in Nunavut and northern Alberta. These tenures are low-cost but high-optionality plays, a strategic hedge against future supply constraints. The annual exploration budget, typically C$10–15 million, focuses on incremental extensions of known mineralization rather than speculative wildcat drilling.

The company’s approach to exploration mirrors its operating philosophy: disciplined, targeted, and value-driven. It extends mine life, protects future throughput, and maintains first-mover advantage in one of the most tightly controlled jurisdictions on Earth.

Pulling It Together

Across McArthur River, Key Lake, Cigar Lake, and Inkai, Cameco controls a portfolio capable of producing more than 30 million pounds per year on a 100% basis. These operations sit firmly in the lowest cost quartile worldwide and feed directly into Cameco’s long-term contract book.

In the first half of 2025, the uranium segment generated over $1 billion in adjusted EBITDA, with a 62% jump in EBIT and triple-digit EPS growth year-over-year. Those margins are the product of deliberate discipline: mining only when the contracts justify it, maintaining flexibility, and avoiding the boom-bust behavior that defined past uranium cycles.

Fuel Services: The Engine Behind Cameco’s Stability

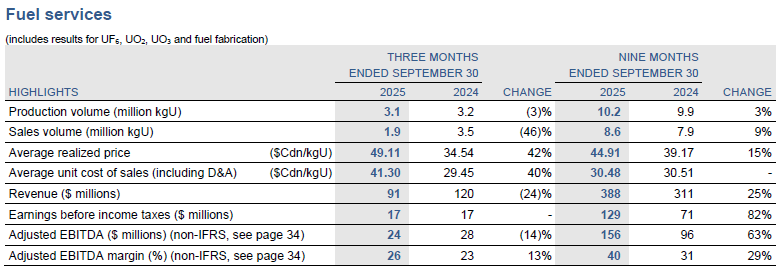

For most investors, Cameco is synonymous with uranium mining. But the company’s fuel services division generates some of the most consistent profits in the business.

Fuel services is now a solid double digit contributor (~14%) to Cameco’s earnings base. Year to date, segment revenue is up roughly 25%, and adjusted EBITDA is up more than 60%, which is what “pricing power in the midstream” looks like when the West is scrambling for non Russian capacity.

If the mines are Cameco’s muscle, fuel services is its metabolism. It converts raw uranium into the forms that power reactors, giving Cameco control over the entire midstream of the nuclear supply chain.

The division operates across three key facilities in Ontario:

Blind River Refinery – where uranium concentrate (U₃O₈) is refined into uranium trioxide (UO₃).

Port Hope Conversion Facility – where UO₃ is converted into uranium hexafluoride (UF₆) for enrichment or uranium dioxide (UO₂) for reactor fuel.

Cameco Fuel Manufacturing (CFM) – where UO₂ powder becomes finished fuel bundles for CANDU reactors in Canada and abroad.

This chain makes Cameco one of the few Western companies capable of taking uranium from ore to finished reactor fuel entirely within its own system. In an era where the West is re-learning how to build nuclear infrastructure, that capability is strategic gold.

Segment Snapshot (Q3 2025):

Refining & Conversion Capacity: ~12.5 M kgU/year

Fuel Fabrication Capacity: 1.2 M kgU/year

UF₆ Conversion Share of Global Market: ~30% (non-Russian)

2025 EBITDA Growth: +36% year-over-year

Operating Margin: ~25–30%

After several years of modest output, Cameco’s fuel business has entered a new phase of demand. Since 2022, Western utilities have been racing to secure non-Russian conversion capacity, and Port Hope, long considered an underutilized legacy asset, has turned into a bottleneck worth owning.

In 2025, Fuel Services delivered its strongest performance on record, with EBITDA up 37% and segment revenue up 36% year-over-year, supported by contract repricing and higher throughput. Unlike the mining side, where realized prices lag spot, conversion and fabrication contracts are shorter and reflect market conditions more quickly. That means when conversion prices spike, as they did throughout 2024 and 2025, the benefits flow directly to the bottom line.

Port Hope

Port Hope is the heart of Cameco’s downstream operations and arguably one of the most strategically important nuclear facilities in the Western Hemisphere. It’s the only commercial-scale converter of uranium hexafluoride (UF₆) in North America and one of only a handful outside Russia.

That scarcity is what gives Cameco pricing power. Conversion prices, once stuck below $8 per kilogram uranium, surged to over $35/kgU by 2025 as Western utilities scrambled to secure stable feedstock. Port Hope runs under long-term, utility-backed contracts that now reflect that new market reality.

In parallel, Cameco has been investing to expand and modernize the facility, improving energy efficiency and throughput reliability. The upgrades, financed internally, are expected to lift effective capacity by 10–15% over the next two years.

Blind River and CFM

The Blind River Refinery, is the world’s largest commercial uranium refinery. It processes uranium concentrate into UO₃ feedstock for both Port Hope and external customers. The site has been operating for over four decades, and its reliability has made it the industry standard for quality and compliance.

At the other end of the process, Cameco Fuel Manufacturing runs a two site operation: Port Hope handles pellet and bundle manufacturing, while Cobourg fabricates key bundle components, supplying CANDU fuel to Ontario Power Generation and Bruce Power.

This fabrication capability gives Cameco direct exposure to the stable, regulated reactor market, predictable, contracted demand that operates independently of spot uranium volatility.

Strategic Significance

Fuel Services has become one of Cameco’s most important assets in a changing nuclear landscape. With Russia’s conversion and enrichment capacity effectively off-limits to Western buyers, utilities are turning to Cameco as their primary non-Russian supplier of UF₆ feedstock. That shift has permanently improved pricing power in the conversion market, and by extension, the profitability of this segment.

Just as importantly, Fuel Services gives Cameco something most miners lack: predictability. Contracted fabrication and conversion work bring in recurring cash flow even during periods of low uranium prices, providing natural downside protection and smoother earnings. It’s a hedge built directly into the business model.

Quick Note

If you want to track this thesis in real time, Premium includes our live portfolio, plus weekly cycle signals, macro commentary, insider activity, and more. Subscribe here: https://upgrade.nuclearupdate.com

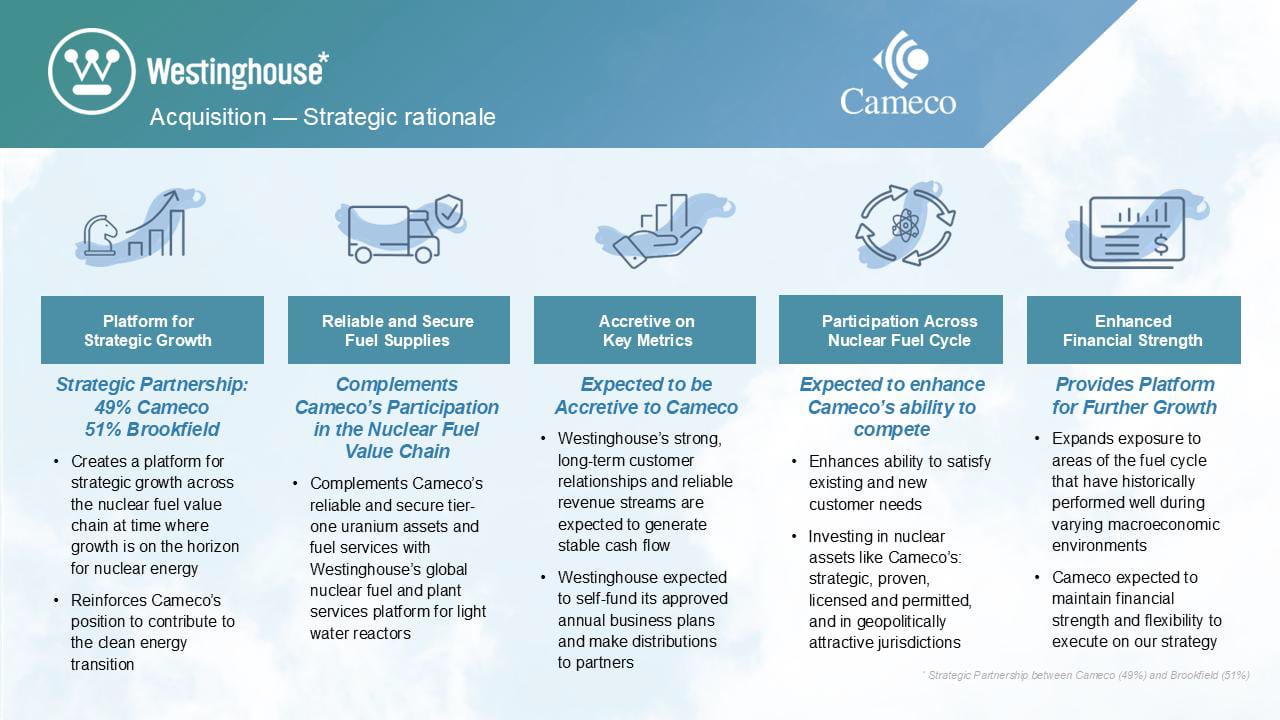

Westinghouse: The Reactor Renaissance

If Fuel Services is Cameco’s stabilizer, Westinghouse is its amplifier. The 2023 acquisition of a 49% ownership stake in Westinghouse Electric Company, alongside Brookfield Renewable Partners (51%), transformed Cameco from a miner into an end-to-end nuclear enterprise.

For decades, Westinghouse has been a cornerstone of global nuclear technology. Its designs power more than 400 reactors in operation and supply roughly half of the world’s nuclear fleet with fuel or services. The company builds, maintains, and uprates reactors across the Americas, Europe, and Asia, and its AP1000 and AP300 designs form the blueprint for the next generation of Western nuclear expansion.

With this acquisition, Cameco added a second earnings engine: downstream services and long-term project execution with recurring, contract-backed cash flows.

The acquisition price valued Westinghouse at roughly US$7.9 billion, with Cameco contributing about US$2.2 billion in equity for its 49% share. It was one of the largest strategic transactions in nuclear history.

In the words of CEO Tim Gitzel:

Cameco now owns a stake in the brain of the nuclear industry.”

The industrial logic behind the deal is simple but powerful. Cameco produces the uranium, converts and fabricates it through its Fuel Services division, and now, via Westinghouse, participates in designing and operating the reactors that consume it.

That vertical integration creates a closed Western fuel cycle, something no other company in North America can claim. It also diversifies Cameco’s earnings profile: when uranium prices dip, reactor service revenue holds steady; when construction activity accelerates, Cameco benefits on both sides of the equation.

From a strategic standpoint, Westinghouse is the Western world’s counterweight to Russia’s Rosatom. As the U.S., U.K., Poland, Czech Republic, and Japan all expand their nuclear capacity, Westinghouse’s technology is at the center of every credible project pipeline.

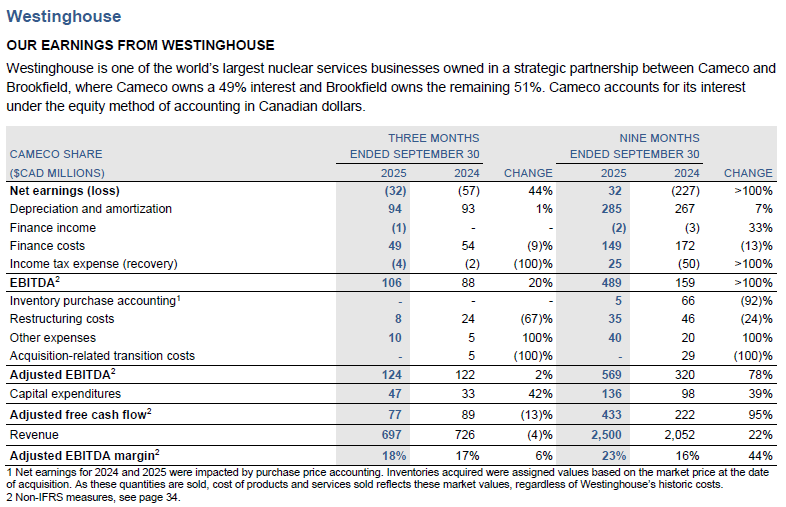

Segment Snapshot (Q3 2025):

Ownership: 49% Cameco, 51% Brookfield Renewable Partners

Cameco’s 2025 EBITDA share: US$525–580 million

2025 Q3 contribution: US$124 million adjusted EBITDA (Cameco share)

Backlog: Over US$5 billion in contracted services

Employees: 9,000 worldwide

Current projects: Dukovany (Czech Republic), Kozloduy (Bulgaria), AP1000 deployments in the U.S., U.K., and Poland

Westinghouse’s earnings are driven by three core segments:

Operating Plant Services (OPS) – long-term service contracts for existing reactors.

Fuel & Engineering Solutions – custom reactor fuel assemblies, uprates, and digital systems.

New Builds (AP1000 and AP300) – engineering and construction support for new reactors.

This mix gives Cameco contracted O&M cash flows today, new build torque tomorrow, and a seat at the table as the West standardizes around a proven reactor platform.

The Dukovany Catalyst

In October 2025, Westinghouse received cash tied to its participation in the Dukovany construction project for two reactors in the Czech Republic, led by KHNP. Westinghouse then made a distribution to its owners, and Cameco received US$171.5 million, representing its 49% share.

For Cameco shareholders, the takeaway is simple. Westinghouse is not just a “future upside” asset. It is already converting Europe’s build activity into reported revenue, and it supports management’s confidence in the US$525 million to US$580 million 2025 adjusted EBITDA outlook for Cameco’s share.

The Numbers

In Q3 2025, Cameco’s share of Westinghouse adjusted EBITDA was US$124 million, bringing the first nine months total to US$569 million.

Margins are strong, cash generation is steady, and, most importantly, the growth pipeline is real. Westinghouse’s backlog exceeds US$5 billion, and management expects 6–10% annual EBITDA growth through the remainder of the decade, driven by reactor modernization, SMR deployment, and Europe’s reactor restarts.

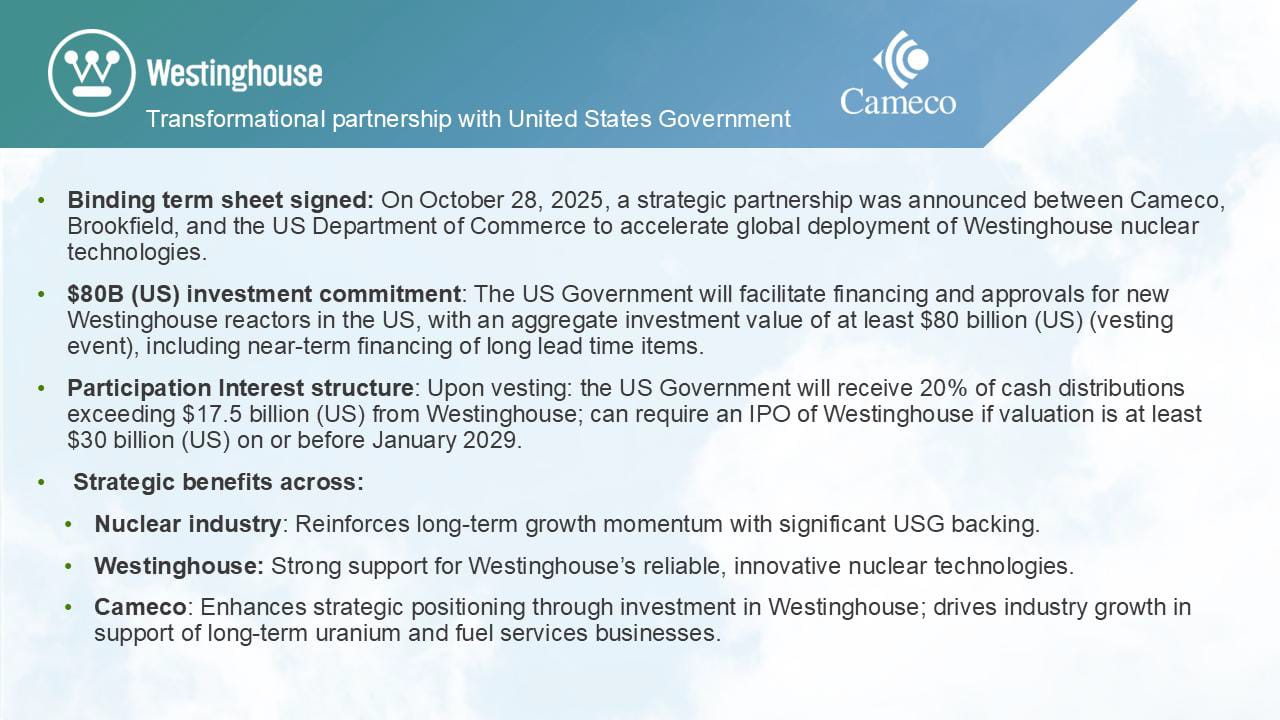

How the U.S. $80 Billion Nuclear Package Changes the Game for Cameco

In late October, Cameco and Brookfield signed a framework agreement with the U.S. government that includes at least 80 billion U.S. dollars of planned investment in Westinghouse nuclear reactors.

On Cameco’s Q3 conference call, management was clear: this is intended to be the catalyst that finally restarts GigaWatt-scale nuclear construction in the United States.

The package is designed to cover the hardest parts of new build: arranging capital, lining up sites and advancing permits and licenses. In Grant Isaac’s words: the United States has decided that “it is time”, and that a larger starter order (not a one-off pair of units) is needed to rebuild the supply chain.

The initial target is roughly 8 to 12 AP1000 reactors, but the language in the agreement is explicit, the 80 billion figure is a minimum. If the first wave proceeds smoothly, nothing prevents the government and U.S. utilities from expanding the program toward the broader goal of tripling nuclear capacity by mid-century. Management has already hinted that interest from utilities accelerated immediately after the announcement, with multiple operators asking how they can participate.

For Cameco and Brookfield, the economics are performance based. Before the U.S. government earns any ownership participation in Westinghouse, existing shareholders are entitled to receive 17.5 billion dollars in cumulative distributions.

Only after that threshold is exceeded would the government hold an equity stake, which management illustrated with an example of roughly 8% at a hypothetical 30 billion dollar valuation. Note: The participation is in Westinghouse alone. It does not extend to Cameco’s other businesses.

Westinghouse’s contracting framework (AP1000 and AP300)

Management has kept the economic framework simple and repeatable:

25–40% of total plant cost captured as revenue.

10–20% EBITDA margins.

So per AP1000 (roughly US$6–8B nth of a kind):

US $2.5–4.0B revenue to Westinghouse.

US $250–800M EBITDA.

Multiply that by 8–12 reactors and Cameco’s 49% stake becomes a multi-billion-dollar structural earnings contributor over the next two decades.

Beyond the Numbers

Disregarding the direct impact of Westinghouse earnings, each AP1000 requires a multi-decade stream of uranium, conversion, enrichment and fuel fabrication. 8 to 12 large reactors in the United States represent a meaningful uplift in long-term fuel demand on their own, with initial core loads followed by 60 or more years of steady refueling.

The strategic significance extends beyond the U.S. market. A credible American build program creates the reference case other countries have been waiting for. It shows that these units can be standardized, sequenced and simplified, which is exactly what is needed to unlock repeat orders across Europe, Asia and the Middle East.

Cameco is positioned to benefit across the entire chain. As a Westinghouse owner, it participates in the engineering and services revenue tied to new AP1000 and AP300 deployments. As a miner and converter, it is one of the most obvious suppliers of the uranium and UF₆ the fleet will need, particularly as Western buyers move away from Russian material. And through GLE, Cameco holds an emerging option on the higher-value enrichment and HALEU segment that next-generation reactors will depend on.

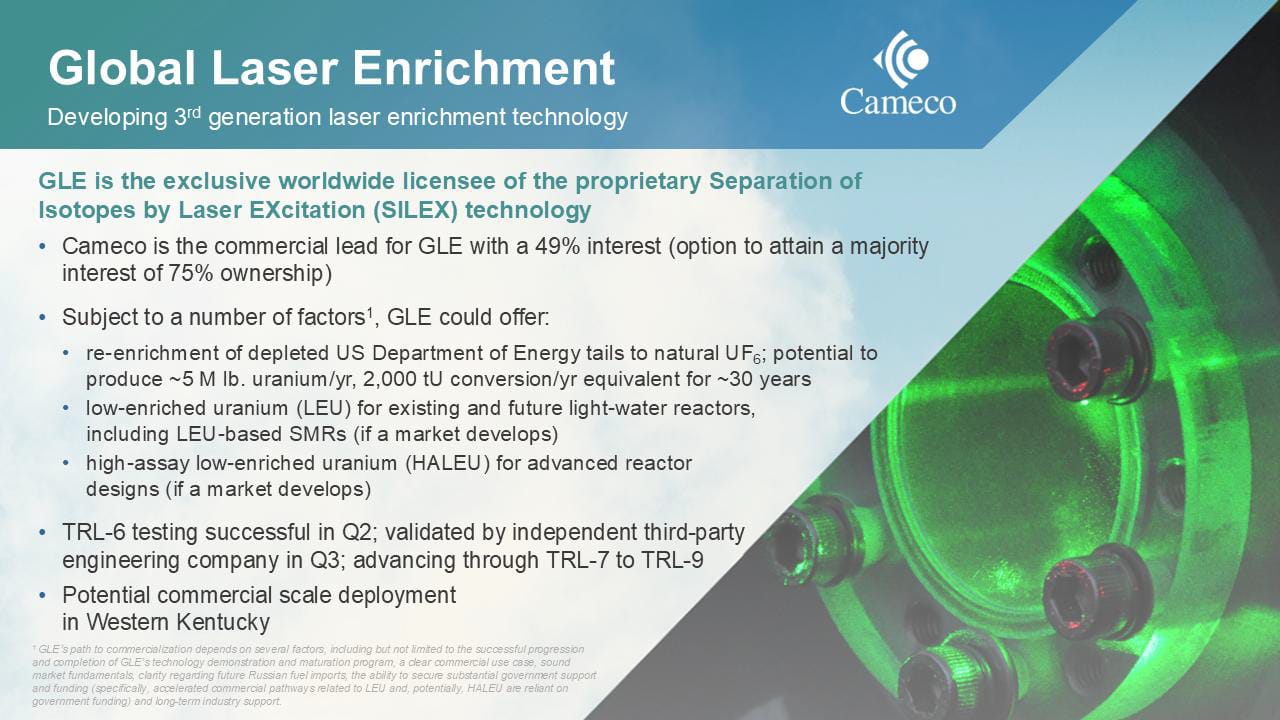

GLE: The Fuel of the Future?

Global Laser Enrichment (GLE) is Cameco’s ticket to the next evolution of the fuel cycle.

GLE is a joint venture between Cameco and Silex Systems that uses proprietary laser-based enrichment technology to re-enrich depleted uranium tails (that’s a big sentence), explain it like I’m five: it turns nuclear waste back into fuel.

The project sits at the intersection of two massive trends: the West’s scramble to rebuild domestic enrichment capacity, and the race to produce HALEU (high-assay, low-enriched uranium) for advanced and small modular reactors. Both depend on exactly the kind of technology GLE is now perfecting.

Project Snapshot (Q3 2025)

Ownership: Cameco 49%, Silex Systems 51%

Location: Wilmington, North Carolina (adjacent to GE-Hitachi’s fuel facility)

Primary purpose: Laser enrichment of uranium tails and production of HALEU

DOE support: Multi-year cooperation agreement and pending licensing pathway

Target start: Pilot operations by 2028, commercial scale early 2030s

Potential capacity: Equivalent to ~5 M SWU (separative work units) annually

Strategic advantage: Lowest-energy enrichment process under development globally

The Technology

Traditional enrichment methods use a lot of power and require massive plants. GLE’s laser approach, developed with the U.S. DOE, uses carefully tuned lasers to separate uranium 235 from uranium 238 more efficiently. The pitch is up to 75% lower energy use, plus more flexibility to produce the enrichment levels needed for today’s reactors and for advanced designs.

In practical terms, GLE could turn the DOE’s large stockpile of depleted uranium tails, often estimated at more than 500,000 metric tons, into usable product. That same pathway also supports production of HALEU, a fuel form many advanced reactors are designed to run on.

What it Means for Cameco

For Cameco, GLE is about optionality. The company has deliberately structured its investment to capture upside without the burden of heavy capital spend until the technology is commercially proven. The pilot phase will be financed primarily through DOE support and internal cash flow from the Westinghouse and Fuel Services segments.

Once operational, GLE could become one of the most strategically valuable assets in the Western nuclear ecosystem. It positions Cameco as a key supplier to the coming wave of SMRs, whose designs require 5–20% enriched fuel, exactly what GLE is designed to deliver.

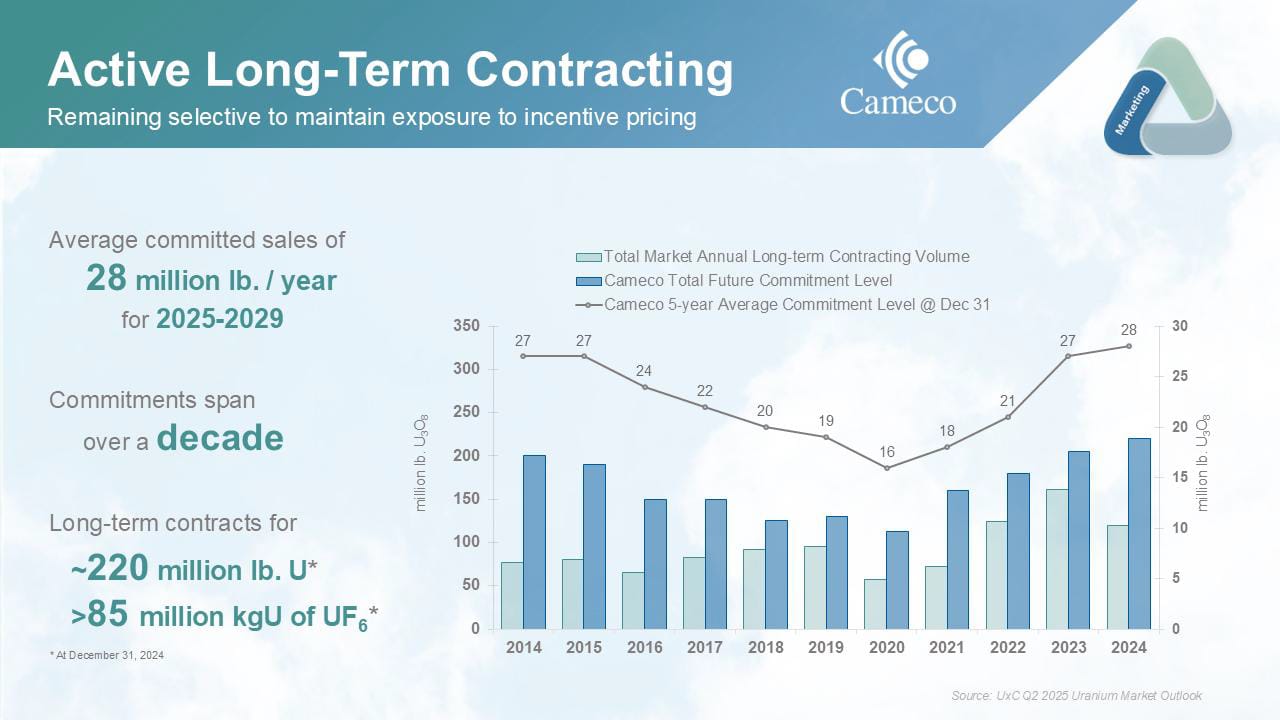

Contracting Strategy: Discipline as a Moat

Cameco’s uranium business is built on one principle: discipline. The company doesn’t chase spot price spikes or overproduce in bull markets. It builds stability through long-term contracts that convert volatile uranium prices into predictable cash flow.

Long-Term Contract Portfolio

As of September 30, 2025, Cameco’s committed uranium sales totaled roughly 28 million pounds of U₃O₈ per year through 2029, covering about 85% of expected deliveries. These contracts form the backbone of the company’s uranium revenue and give it one of the most secure order books in the resource sector.

For 2025, Cameco expects total uranium deliveries of 32–34 million pounds, including a small portion of purchased material to balance timing. At an average realized price of US $61–63 per pound, this equates to approximately US $1.9–2.0 billion in uranium revenue.

That figure is already largely locked in. Each contract in the book includes a fixed or formula-based pricing component that adjusts over time but still guarantees cash flow even if the spot market weakens.

Pricing Structure

Cameco’s contracts are structured to capture upside while protecting margins:

Base-escalated contracts: Fixed at signing, indexed to inflation.

Market-related contracts: Pegged to spot or long-term uranium benchmarks, usually with floors in the US $45–50/lb range and ceilings around US $85–95/lb.

Hybrid contracts: Blended mechanisms that mix both approaches for stability and exposure.

This model gives Cameco a deliberate lag effect versus spot prices. In practice, realized prices adjust slowly upward as older, low-priced contracts roll off and are replaced by new, market-linked agreements.

That smoothing mechanism is why Cameco’s realized price in Q3 2025 averaged US $62.21/lb, even though spot dipped to the low 70s late in the quarter. The Q3 2025 filings show an average realized price of US $62/lb (U₃O₈), up ~4 % year-on-year, even though spot prices dipped 6% (Q3).

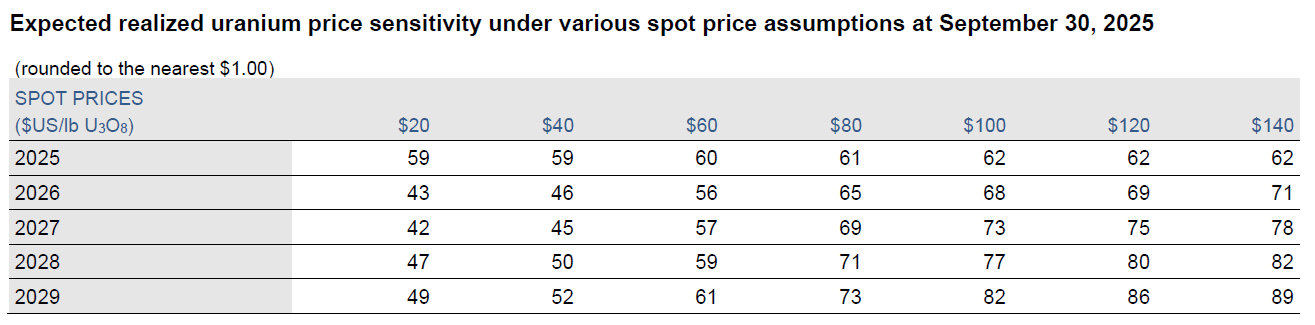

To help quantify how the contract portfolio reacts under different market conditions, Cameco publishes a quarterly realized-price sensitivity table. This table is not a forecast, it is simply a snapshot of what the current contract book (as of September 30, 2025) would imply if spot prices stayed fixed for each period shown.

Floors, Ceilings, and Flexibility

Cameco’s contracts include built-in price escalators (typically 2 % U.S. inflation assumptions) and delivery flexibility, allowing utilities to shift volumes year-to-year. The company models realized-price sensitivity quarterly; under current contracts, a flat US $80 spot environment yields roughly US $61/lb realized in 2025, climbing into the high $60s by 2027.

Most contracts also include +10/–15% annual volume flexibility, allowing utilities to adjust deliveries based on refueling schedules. This flexibility gives Cameco the operational freedom to align mine output with customer needs while maintaining high plant utilization and consistent cash flow.

Scale and Predictability

For 2025, Cameco guides 32–34 million lbs in deliveries at an average realized price of C$ 87/lb and a unit cost of C$ 59–63/lb, implying robust 35–40 % gross margins. The long-term contract book underwrites a significant portion of that volume; only about 1 million lbs will be sourced from opportunistic market purchases to balance supply.

At current guidance, Cameco’s contract book supports roughly C$2.9–3.0 billion in uranium sales revenue for 2025, generating C$1.1–1.2 billion in uranium EBITDA at an average unit cost of C$59–63/lb. Over the full term of the book (2025–2029), contracted deliveries represent about 140 million pounds, implying more than C$8–9 billion in cumulative uranium revenue under existing price formulas and escalators.

Utilities trust Cameco not only for volume but for credit quality and reliability. Cameco doesn’t just sell uranium, it sells certainty, a scarce commodity in today’s geopolitical energy market.

Financials & Fundamentals

The Q3 2025 results show a company that is shaping the future of the uranium cycle.

Headline Results (nine months ended Sep 30, 2025)

Total revenue: US $2.28 billion (up 17%)

Gross profit: US $697 million (up 31%)

Adjusted EBITDA: US $1.34 billion (up 33%)

Net earnings attributable to shareholders: US $391 million (vs. US $36M in 2024)

Adjusted net earnings: US $410 million

Adjusted EPS: US $0.94

Operating cash flow: US $731 million YTD (up 94%)

Sustaining + development capex: US $485 million

Free cash flow: ~US $246 million (before working capital normalization)

These numbers are the result of a contracting book that reprices upward each quarter, fuel services margins expanding, and Westinghouse feeding a new layer of downstream earnings.

2025 full-year capex guidance remains tight at US $650–700 million, focused on:

Optimization work at McArthur River / Key Lake

Port Hope modernization and UF₆ throughput increases

Digital upgrades and process improvements across the fleet

Even with these investments, Cameco remains in a near-net-cash position.

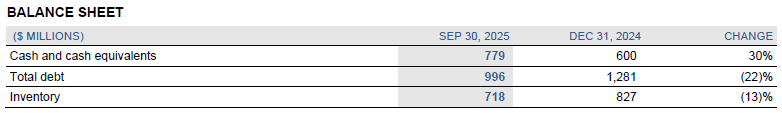

Balance sheet summary:

Cash & equivalents: US $779 million

Total debt: US $996 million

Net debt: US $217 million

Inventory: US $718 million

This is one of the cleanest balance sheets in the entire resource sector. Cameco can self-fund sustaining capex, maintain inventory flexibility, and deploy capital through downcycles without leverage ever becoming a constraint.

Where the Money Is Coming From

Cameco now earns its keep across three distinct engines:

1. Uranium

Revenue: US $1.847 billion

Gross profit: US $578 million

Adjusted EBITDA: US $861 million

Delivered volume: 21.8 million lbs

Average realized price: US $60.35/lb (up 4% YoY)

Gross margin: 31%

Despite slightly lower production (McArthur River ramp timing), uranium revenue climbed 12%. The combination of stronger realized prices, a heavier term-delivery mix, and a weaker CAD has expanded margins across the board.

2. Fuel Services

Revenue: US $388 million (up 25%)

Adjusted EBITDA: US $156 million (up 63%)

EBITDA margin: 40%

Port Hope continues running near licensed capacity, and demand for non-Russian conversion keeps adding up, and is turning into one of Cameco’s most reliable margin contributors.

3. Westinghouse

Adjusted EBITDA (Cameco share): US $569 million for the first nine months

Net earnings contribution: US $32 million YTD

One-time distribution received in October: US $171.5 million US tied to Dukovany

Management emphasized on the Q3 call that net earnings can be noisy due to purchase-price-allocation amortization, so adjusted EBITDA is the best indicator of the underlying strength of the business. Westinghouse’s operating performance has strengthened materially, and none of these numbers yet include the uplift from the new U.S. $80 billion build program.

Valuation & Investment Outlook

Cameco is one of the few companies in the resource sector where valuation is both the biggest debate and the biggest misunderstanding. Critics see a P/E pushing 90x and scream overvaluation. Long-term investors look at the same number and shrug, because Cameco’s earnings base is only now beginning to reflect the cycle it spent a decade positioning for.

To be clear: the disagreement is not about whether Cameco is central to the nuclear cycle, it is about how much of that cycle you are paying for upfront.

The truth sits somewhere in the middle: Cameco is expensive compared to the broader market, but cheap compared to what it is becoming.

At ~US $80 per share, Cameco trades around:

Forward P/E: 84–90×

Trailing P/E: 95–100×

EV/EBITDA: 28–32× forward

EV/Sales: ~10–12×

Price/Book: ~8×

PEG ratio: ~0.27 (half the sector average)

That PEG ratio tells you the market is pricing fast earnings growth, but not absurd growth. And that expectation isn’t guesswork, Cameco’s earnings base is mechanically expanding through 2026–2028 as higher-priced contracts replace older volumes, floors step up, conversion margins remain elevated, and Westinghouse adds a new, recurring layer of downstream earnings. Even with conservative uranium assumptions in the US $70–80/lb range, EBITDA and EPS continue to climb year after year.

One simple tell: since early 2024, uranium spot prices are down some 20% while Cameco’s share price has roughly doubled. The market is no longer valuing CCJ as a simple spot proxy, it is paying for the contract book, fuel services, and Westinghouse optionality on top of the pounds.

On that basis, today’s valuation is actually low compared to Cameco’s own recent history. Cameco’s P/E was over 250x in September 2024, long before the 80-billion-dollar U.S. reactor build program existed. If you’re comparing Cameco to Cameco, not Cameco to Exxon, the stock is still trading at a discount to its own nuclear-cycle pricing.

A high premium is there for a reason, the market is pricing in Cameco as:

1) The backbone of Western uranium supply

2) The only full-cycle nuclear company in North America

3) The largest non-Russian converter

4) A 49% owner of Westinghouse with AP1000 and AP300 exposure

5) The anchor supplier to U.S., EU, Japanese and Korean utilities

Cameco earns recurring cash flow from mining, recurring cash flow from conversion, recurring cash flow from fuel-fabrication, and recurring cash flow from Westinghouse service contracts. Each part of the business reinforces the others as nuclear scales.

The ETF effect

Cameco is the anchor position in the uranium ETF universe. URA and URNM both allocate more heavily to Cameco than to any other single name. It typically represents ~22–25% of URA and ~18–22% of URNM. The exact weight moves around with rebalances and relative performance, but the point holds, CCJ is often the largest single position in the major uranium ETFs.

That means every dollar of passive inflow into “uranium exposure” disproportionately flows into Cameco first. In practice, the ETFs function as a constant buyer of CCJ, especially during periods of sector momentum, index rebalancing, or macro-driven inflows.

This is part of why Cameco tends to lead every leg of the sector’s move. It’s positioned to capture the mechanical flows of ETF-driven capital.

U.S Reactor Package and India’s $2.8 Billion Uranium Deal

Layer the U.S. reactor package on top of that and the valuation starts to look less abstract and more like a discounted cash flow problem.

The 80 billion dollar framework is structured around a starter fleet of roughly 8 to 12 AP1000 units, with clear performance hurdles and a minimum return for existing Westinghouse owners before the government takes any equity.

Each one of those units represents decades of uranium, conversion and fuel demand, plus a multi-billion dollar engineering and services contract for Westinghouse.

If even half of that initial fleet proceeds on time, Cameco’s earnings base in the 2030s will look very different from the trailing numbers that produce today’s 90 P/E.

And the U.S. is not the end of the pipe. Countries like Saudi Arabia are openly shopping for multi-unit nuclear programs, while European and Asian utilities are lining up AP1000 and AP300 style offerings as they look to replace coal and gas capacity. A credible U.S. buildout does not just help Cameco sell more pounds, it creates a standardized template that other governments can copy, with Westinghouse and its owners sitting in the middle of every follow-on discussion.

Now add the other side of the setup, long term procurement is starting to show up again in sovereign sized blocks, not just utility sized blocks. Reports indicate Canada and India are close to a uranium export agreement worth about US$2.8 billion, structured as a 10 year arrangement with Cameco supplying the material.

This was reported alongside a broader diplomatic thaw, with leaders meeting on the sidelines of the G20 and agreeing to restart work on a comprehensive trade agreement, targeting US$50 billion in bilateral trade by 2030. That is the kind of umbrella under which long term fuel supply actually gets signed and then kept.

The Upside Is Not In The Models

Recent price targets:

Raymond James: US$110

Canaccord: US$105

BMO: US$100

RBC: US$95

Morgan Stanley: US$92

TD: US$88

Red Cloud: US$115

Remember none of these models include the full impact of 8–12 new U.S. AP1000s or the GLE enrichment curve, or the India uranium deal. They’re valuing the company based largely on the existing contracting cycle and Westinghouse backlog.

Put differently, the market is already paying a premium for Cameco’s current position in the fuel cycle. It is not yet fully paying for what Cameco becomes if the U.S. program executes, Saudi and other sovereign buyers commit to multi-reactor programs, and the Western grid genuinely starts to replace fossil baseload with nuclear steel in the ground. That gap, between the “already expensive” headline multiple and the earnings power implied by the buildout now taking shape, is where the long-term upside lives.

That gap between where Cameco is priced and where its strategic positioning is heading is the investment opportunity.

Risks

Cameco’s setup is one of the strongest in the entire uranium sector, but it isn’t risk-free.

The biggest near-term operational risk sits at McArthur River and Key Lake, where advancing into new production areas always carries the risk of hiccups, cost fluctuations, or temporary output constraints. These aren’t new issues, but they can still create noise quarter to quarter.

Westinghouse is the biggest swing factor. It is throwing off strong adjusted EBITDA, but it still posted a net loss this quarter and sits on long, politically sensitive project timelines. If schedules slip, or if the U.S. partnership structure evolves toward a spin-out or heavier government involvement, the market could quickly reassess how much of that downstream upside it is willing to capitalize today.

Any delays in site licensing, engineering milestones, or international build programs would not break the thesis, but they can push earnings recognition further out and inject more volatility into the multiple.

Then there’s uranium itself. Cameco’s contract book shields it from spot price swings, but not forever. A sustained pullback in spot or a slowdown in term contracting could delay some of the higher-priced volumes investors are expecting. The company is insulated, not immune.

Valuation also creates its own risk. The market is already pricing Cameco as the backbone of the Western fuel cycle, which means expectations are high. Even a minor operational miss or a softer contracting quarter could trigger sharp pullbacks simply because the stock sits on a premium multiple.

And finally, the broader fuel cycle still depends on geopolitically sensitive components. Enrichment bottlenecks, transport disruptions, or instability in key jurisdictions like Kazakhstan can affect pricing, timing, or logistics even if Cameco’s own operations are stable.

None of these risks break the long-term thesis, but they are the bumps that can shake the stock in the short term and should be monitored.

Wrapping Up

If you only remember one thing from this deep dive, make it this: Cameco is the Western fuel cycle in one ticker. Real production, real conversion, real fuel fabrication, and now real downstream earnings through Westinghouse as builds move from PowerPoint to purchase orders.

The stock is priced like a winner because it is one, but the bigger question is whether the market is fully pricing the next leg: scaled U.S. builds, Europe’s restart wave, and a tightening non Russian fuel chain that makes “reliability” the most valuable commodity in the sector.

Want the portfolio + weekly signals?

If you enjoyed this Cameco deep dive, Nuclear Update Premium gets you the full toolkit:

📊 Live model portfolio (holdings, allocations, average entry prices)

📈 Weekly “where are we in the cycle” indicators (spot vs term, utility activity, sentiment)

🧠 Macro commentary, insider transactions, deep dives and more

Join here: https://upgrade.nuclearupdate.com

-Fredrik

What did you think of this week's email? |

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research

Reply