- Nuclear Update

- Posts

- ⚛️How to Own Physical Uranium (Legally & Easily)

⚛️How to Own Physical Uranium (Legally & Easily)

Today we are talking about something that has been weirdly hard for regular people to do for decades, even as the nuclear story has gone from niche to front page: owning physical uranium.

Welcome to Nuclear Update.

Today we are talking about something that has been weirdly hard for regular people to do for decades, even as the nuclear story has gone from niche to front page: owning and investing directly in physical uranium.

You could buy miners, you could buy ETFs, you could buy funds-of-funds (that may or may not actually hold the yellowcake they sold you).

What you could NOT do (unless you had institutional size) was simply say:

“I want to own my U₃O₈, no middlemen, no games.”

Let’s start with the obvious question.

⚛️Why Physical Uranium Is Back On The Menu

Uranium is no longer just a contrarian bet for nuclear nerds. It is the fuel sitting at the intersection of three big forces at once:

Big tech building nuclear powered data centers for AI

Governments scrambling to hit net zero while keeping the lights on

A global grid that needs round the clock clean baseload (not vibes).

If you are a regular reader of Nuclear Update you know nuclear reactors are running longer, lifetime extensions are stacking up, and new builds are finally moving from slide decks to steel and concrete. That is pure demand growth for uranium over a multi decade time horizon.

In the meantime, uranium miners keep reporting problems and revising their estimates downward. Mining uranium is hard!

Uranium as a commodity behaves differently from the usual suspects (and more like Keyser Söze).

It does not care much about oil cycles, it does not move in lockstep with gold, and it has historically been uncorrelated with broad equity indices like the S&P 500.

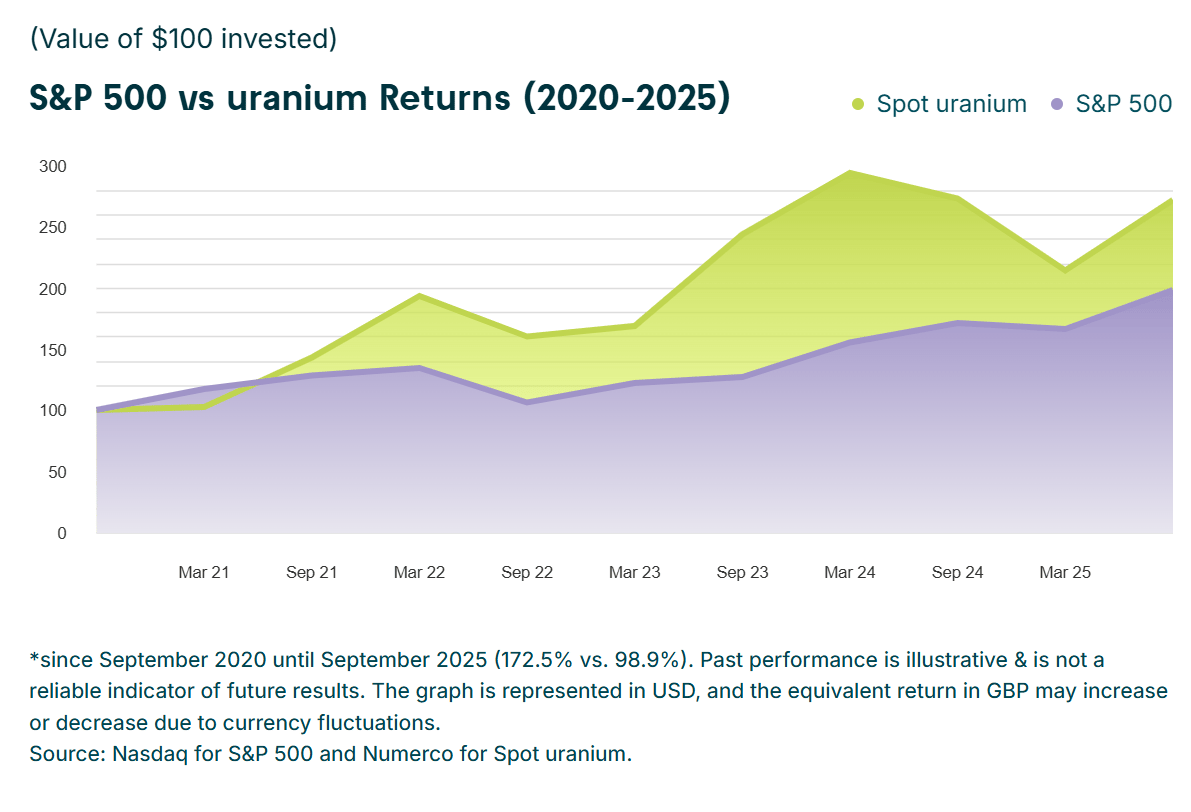

Speaking of the S&P, over the last 5 years spot uranium has nearly doubled its return: 172.5% vs. 98.9% for the S&P.

Buying physical uranium is about adding something to your portfolio that has strong secular demand drivers and is tied to hard infrastructure and long term contracts. It is also a way to diversify, rather than owning the same exposures everyone else already holds.

So if the thesis is that compelling, why has it been so hard for a normal person to simply own the commodity itself?

🚫 Why It Has Been So Hard To Own U₃O₈

Historically, owning direct physical uranium was an exclusive club.

If you wanted to buy actual U₃O₈ through over the counter deals, you were effectively playing in the utility and trader leagues. Typical ticket sizes were on the order of 7 million dollars or more, with legal work, logistics, and compliance that only institutions could handle.

And even if you had the money, you still couldn’t take delivery.

Unprocessed uranium is a regulated nuclear material. Possessing it requires licensing, radiation safety protocols, secure transport, and storage inside approved nuclear facilities.

You cannot legally keep drums of yellowcake in your garage, your warehouse, or anywhere else you own. Without custody, you were stuck trusting intermediaries, and the chain of ownership became a black box. Was it really “yours”? Could you verify it existed?

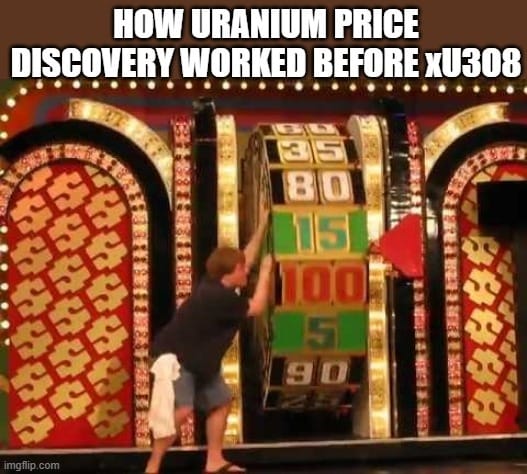

Then there was the third problem: price discovery.

Uranium never traded like normal commodities. There was no live, transparent spot market, no open exchange with a proper order book, and no real time benchmark. Prices were set through private negotiations and subscription reports. Even if you managed to secure a deal, how did you know you were buying at the right price? What did “fair value” even mean?

It was the equivalent of the shrug emoji: ¯\_(ツ)_/¯

Put those three problems together, and the result was simple: unless you were a utility or a trading house, you had no way into the real uranium market.

Everyone else had to settle for indirect exposure:

ETFs and managed funds, tracking synthetic ‘uranium exposure’ that isn’t tied to physical U₃O₈.

Mining stocks, with all the usual operational and geopolitical risks

Structured products, that added layers of fees and complexity

These can all play a role in a portfolio, but none are the same as direct ownership of uranium itself.

On top of that, traditional products trade only during local exchange hours. If you live outside North America or Europe, the windows shrink even further.

So the market sat in this strange contradiction. Uranium was one of the cleanest, highest conviction long term energy transition stories, yet the commodity at the center of it was effectively sealed off behind institutional walls.

That is the context for xU3O8.

🧱 Meet xU3O8: Tokenized Physical Uranium

Uranium.io launched in December 2024 with a simple (but not simplistic) goal: make owning physical uranium accessible to investors everywhere. Since launch, they have picked up attention from both crypto and mainstream finance.

There have been more than 200 media mentions across outlets like Reuters, CNBC, Yahoo Finance and MarketWatch.

For a niche that was once the definition of “illiquid and opaque”, that kind of coverage is a sign that investors are actively looking for new ways to express the uranium thesis.

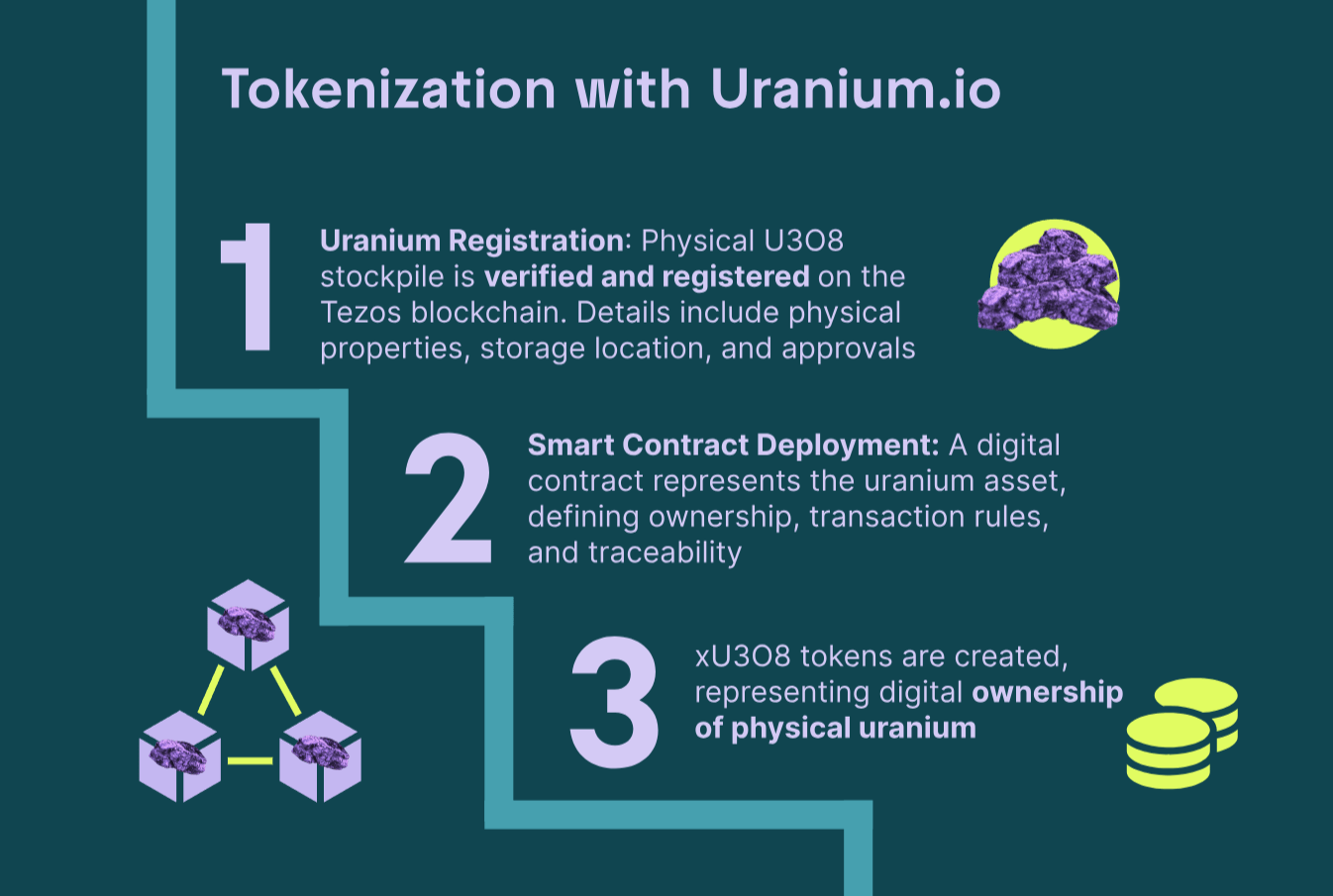

The core of Uranium.io’s effort is xU3O8, tokenized uranium that represents direct ownership of physical U₃O₈ stored in secure facilities.

So what does “tokenized uranium” actually mean? It means you own real uranium, but instead of getting a drum of yellowcake shipped to your house (which is illegal), you get a digital receipt that proves how much uranium belongs to you.

It is no different from how gold vaults issue digital certificates, except this version uses modern software instead of old databases, which makes it faster, more transparent and accessible worldwide, 24/7.

Under the hood, that software is a blockchain: a shared ledger everyone can see and verify, but no one can secretly change in the background.

You are not buying a crypto coin, an NFT, or a synthetic derivative that loosely tracks some index.

You are buying a claim on real uranium that you can’t legally store yourself.

All of the physical U₃O₈ backing xU3O8 is held inside a regulated storage facility operated by Cameco, one of the largest and most trusted uranium players in the world. The uranium sits in a dedicated storage account, overseen by Archax as the regulated trustee, and verified through monthly proof-of-reserves statements on uranium.io.

In other words, the material isn’t hypothetical or “somewhere in the system”, it is real uranium held in a real depository, audited and ownership is represented by the tokens in circulation.

Through the uranium.io platform, holders can buy and own physical uranium, starting from as little as 5 dollars and trade their uranium with near instant settlement, 24 hours a day, 7 days a week.

For traders who live on crypto exchanges, xU3O8 has also been listed on a growing set of global venues, including Gate, MEXC, KuCoin, Hanji, with more listings on the way.

The net result is that physical uranium exposure is no longer tied to a specific national stock exchange.

From a portfolio construction angle, that matters. You are not stuck waiting for “market open” to rebalance, and you can treat uranium as a truly global asset class rather than something tied to one jurisdiction.

Which brings me to my favorite part of the whole project: the live uranium spot price.

📈 How The Live Uranium Spot Price Works

For decades, uranium spot prices lived in a dark corner of the market. Deals were negotiated privately, reported with a lag, and wrapped in paywalled reports. If you were not a utility or trader, it was almost impossible to know what uranium was really trading at right now.

Uranium.io tackles that with a live uranium spot price feed.

The system ingests real market data from Numerco (the most widely followed uranium price reporter). It then combines that with other data sources that directly or indirectly influence uranium prices, including recent deals, firm bids and offers, and related market signals.

All of that goes into a model that publishes a fair value estimate for U₃O₈ in between the official price prints. It updates every minute and gives investors a real-time view of where the uranium market is likely trading. It is not an executable price for every trade, and it may differ from any individual reporter’s number at a given moment, but it finally provides a live, transparent benchmark in a market that has never had one.

The live feed brings uranium out of the shadows. Instead of waiting for a monthly PDF or relying on whispers from traders, investors can finally see what the spot market is doing right now.

This transparency is a core part of the value proposition. You are not just owning physical uranium, you are owning it with a clear, continuously updated window into its price.

⚛️ Wrapping Up

Physical uranium used to live in a world of long phone calls, thick contracts, and seven figure tickets. Great if you were a utility, basically impossible if you were an individual.

xU3O8 and uranium.io change that equation. They take the same U₃O₈ that fuels reactors, record ownership on a secure blockchain, and make it available in pieces that fit into regular portfolios, not just institutional balance sheets.

If you have ever wanted truly direct, transparent exposure to physical uranium, without needing utility scale capital, this is one of the first serious attempts to give you exactly that.

– Fredrik

For more information on xU3O8, tokenization, proof of reserves and live uranium spot price, visit their website: uranium.io.

Disclosure: This Deep Dive was created in collaboration with Uranium.io, which sponsored this post. All analysis and opinions are those of Nuclear Update.

What did you think of this week's email? |

DISCLAIMER: None of this is financial advice. Nuclear Update is for informational and educational purposes only, it’s here to help you understand the world of uranium, energy, and the markets that orbit them, not to tell you what to buy or sell. Nothing in this article should be taken as a recommendation or solicitation to make any financial decision. Always do your own research, double-check sources, and talk to a licensed professional before making investments. Markets move fast, opinions change, and yes, sometimes even Fredrik gets things wrong.

Reply