- Nuclear Update

- Posts

- Nuclear Update Premium July 5, 2025

Nuclear Update Premium July 5, 2025

Welcome to Nuclear Update Premium – July 5, 2025

This is what we got for you this week:

📈Markets Are High on Stimulus Again

☢️ Uranium: Calm Surface, Big Undercurrents

📊Portfolio moves + This Months’ DCA

📬 Insider transaction action

🗞️Nuclear newsflow decoded

🎙️Interviews worth your weekend

Lets go!

📈 Market Sentiment Check: Markets Are High on Stimulus Again

Markets just pulled a full V-shaped flex.

The S&P 500 is sitting around all-time highs. Bank stocks are ripping. And macro risk? Mostly getting shrugged off. What changed?

Washington’s back to running it hot.

Trump’s new “One Big Beautiful Bill” just cleared both the House and Senate—and now heads to his desk for signature. It’s a monster: $4 trillion in added debt through 2034, ballooning deficits (~7% of GDP), and front-loaded stimulus that makes post-COVID spending look tame.

Even juicier: Trump’s hinted that the Treasury might start issuing mostly short-term T-bills instead of the usual mix of short- and long-term government bonds. That may sound like a small tweak, but it’s a big deal.

Short-term debt (like T-bills) gets repaid quickly and doesn’t lock in high yields for investors the way long-term bonds do. That means less attractive “safe” options for capital — and more cash flows into risk assets like equities, commodities, and yes, uranium plays.

This is basically Yield Curve Control Lite: the government indirectly pushes down long-term yields without announcing a formal bond-buying program. Historically, when this kind of liquidity wave hits, it fuels bull runs in everything from tech stocks to hard assets.

Add to that this week’s surprise payroll contraction (first in two years), cooling wage growth, and sticky inflation—and you’ve got a market betting Powell pivots dovish whether he wants to or not.

The macro setup is turning tailwind. Not just for equities—but for commodities, energy, and anything real.

Meanwhile, geopolitical tension is simmering just below the surface:

EU and U.S. are racing to avoid a July 9 tariff cliff. If no deal is struck, nearly €380B in trade gets slapped with 50% tariffs—autos, steel, aluminum, the works.

Japan’s in the crosshairs too. Trump’s threatening action over rice (yes, rice), and Tokyo’s scrambling to avoid escalation before its July 20 elections.

Markets are showing nerves: Japan’s Topix index dipped after Trump reignited tariff threats, and UK bond yields jumped as political uncertainty flared around the Chancellor—reminding investors how fast confidence can crack.

Still, U.S. bank stocks are ripping—a classic sign the market’s betting on lower rates, looser policy, and a risk-on cycle. The KBW Bank Index is up 30% since April and hedge funds are buying with both hands.

When banks (especially regionals) are surging, it typically means:

Investors are rotating into cyclicals.

Rate cut bets are increasing.

Credit/liquidity conditions are loosening.

In other words, the same macro tailwinds (stimulus, dovish shift, yield curve steepening) that support banks… supercharges commodities too.

TL;DR:

✅Risk-on sentiment is back

✅Treasury going heavy on T-bills adding cash to the system

✅Powell likely to pivot dovish keeping borrowing costs low

✅ Together: ultra-bullish for risk assets and commodities

⚠️ But tariffs and trade frictions could change the game fast

☢️ Uranium Sentiment: Calm Surface, Big Undercurrents

This is the kind of macro stew that puts strategic commodities back in the spotlight. Tariff risk, supply insecurity, and debt-driven liquidity all reinforce one thing:

Energy security isn’t optional—it’s the trade.

Spot price is holding firm at $76.50 according to Uranium Markets. Long term price was $80 at the end of June (the fifth consecutive month) according to Cameco.

Utilities are still asleep. Yes, we’re entering the seasonally slow stretch—but there’s nothing seasonal about this cycle. Term contracting is still way behind pace (only ~26M lbs year-to-date, barely a third of replacement rate). This signals a massive wave of future buying is inevitable.

Equities already started moving. After getting smacked ~30% from Jan to April, uranium miners have clawed their way back—posting 11 consecutive weeks of gains. That V-shaped rally since early April has been quiet, methodical, and driven by improving sentiment: tariffs stayed off uranium, the macro backdrop flipped risk-on, and the noise traders cleared out.

Institutions are moving in. Half of the participants in SPUT’s $200M raise were new to the vehicle—and many were from Australia, where short interest in uranium names remains elevated. Capital is rotating into the space, even as retail flows stay muted.

Oh, and SPUT still holds roughly ~$120 million for stacking more U3O8.

Retail are largely washed out. What’s left are the fundamental holders, long-term funds, and macro players starting to re-engage. The conviction is still there—it’s just sitting under the surface, waiting for a catalyst to crack things open.

And that catalyst might not be far off…

Mark your calendar: WNA 2025 in September. Every two years, the World Nuclear Association updates its uranium demand forecasts (the last one kicked off a 6-month rally). With life extensions, SMR momentum, and hyperscalers eyeing 24/7 clean power, odds are high we’ll get another bullish revision.

At the same time, supply’s still dragging, no greenfield production has come online yet. The bottleneck is real, and the demand side keeps getting stronger.

This isn’t a sector running on hype anymore—it’s running on fundamentals. Sentiment has stabilized, positioning is cleaner, and the summer may not be sleepy at all. Smart money is watching, waiting, and loading.

Final Sentiment Themes

Hot money is gone, fundamentals remain: The speculative crowd has exited, leaving behind more committed, long-term investors.

Volatility is normal: Short-term corrections happen, but the fundamental case is intact and strengthening.

Patience is key: Uranium bull markets are long and bumpy—conviction is needed to ride out the volatility.

📊 Portfolio Moves

The Nuclear Update Premium Portfolio has been updated with the latest price action and refreshed the technical setups across the board.

We also added Western Uranium and Vanadium (WUC) to the watchlist:

⚪ Western Uranium & Vanadium (WUC / WUAVF) — New Watchlist Entry

Company Overview: Western Uranium & Vanadium is a U.S.-based miner focused on restarting and scaling production at its fully-permitted uranium-vanadium mines in Colorado and Utah. The company is also developing the Mustang Processing Facility to vertically integrate future ore processing.

Strategic Role: WUC offers near-term U.S.-based uranium production exposure, complementing a portfolio that includes established producers (CCJ), developers (DNN), enrichment (LEU), and royalties (UROY). Unlike UUUU, WUC is more narrowly focused on restarting permitted legacy mines. Its inclusion adds jurisdictional depth within the U.S. while introducing vanadium as a secondary exposure, which brings some diversification but also potential commodity noise.

Fundamentals: The company is early-stage and pre-revenue, with limited current cash flow and ongoing capital requirements. It raised CAD $5M in 2025 to advance mining and mill development. Operational execution, permitting, and financing are key risks, though its assets are permitted and in favorable jurisdictions.

Technical Setup: RSI is neutral (48), MACD is negative (–0.01), and short- and mid-term moving averages (10–50 day) have turned bearish. Price recently broke below its 50-day MA and is testing support at ~US $0.76. Volume is low, and no accumulation signals are present.

Status: Watch — While the long-term potential remains compelling, the current technical setup and early-stage risk profile warrant waiting for clearer signs of trend reversal or operational progress.

💵 How We Dollar-Cost Average Into the Portfolio

Each month, we simulate adding $1,000 to the portfolio—just like a real investor would. It’s our way of staying disciplined, smoothing out volatility, and showing how to build positions over time without chasing tops or panic-selling dips.

But this isn’t split evenly. Every DCA update reflects:

✅ Conviction – Are we pressing into our high-conviction plays or trimming risk?

✅ Technical Setup – Are we buying breakouts or waiting for better entries on oversold names?

✅ Portfolio Balance – Do we need more exposure to fuel cycle, physical uranium, or SMRs?

We drop these updates every first Saturday of the month.

It’s your tactical roadmap for building a nuclear portfolio like we would—based on conviction, discipline, and timing. Follow the $1,000 simulation as-is, or scale it to match your own capital.

💵 July DCA Update: Where We’re Deploying This Month’s $1,000

We’re building disciplined positions ahead of what we believe is the next leg higher.

If you expect uranium to revisit $90–100+, now is the time to prioritize:

High-conviction names

Strong technical setups

Clean exposure to price upside

Here’s how we’re deploying this month’s $1,000 in simulated capital:

🟢 $550 into UROY – Royalty Exposure with Leverage

Uranium Royalty Corp remains the sector’s only pure-play royalty company. With no mining operations or development risk, it offers asymmetric upside when uranium prices move. If spot strengthens, UROY’s NAV expands significantly.

Cleanest technical setup with positive MACD, rising RSI, and solid support.

🟢 $450 into DNN – Undervalued Developer with Upside

Denison Mines continues to build a high-quality project portfolio in the Athabasca Basin. The company offers a compelling blend of near-term production potential and long-term resource value.

Strong base formation and a supportive technical trend make this a strong candidate for dollar-cost averaging.

❌ Why Not the Others (This Time)?

LEU – Indirect Exposure

Centrus Energy plays a vital role in the nuclear fuel cycle through HALEU enrichment, but its performance doesn’t track closely with spot uranium prices.NuScale (SMR) – Great Story, Wrong Trade

NuScale remains a high-profile name in the SMR space, but it’s not a uranium price play.UUUU – Weak Technicals, Mixed Focus

While Energy Fuels maintains uranium assets, its diversification into rare earths and vanadium dilutes its commodity focus slightly. Technically, the chart remains under pressure, with flat MACD, soft volume, and a lack of breakout signals. We’ll revisit this one when the setup improves.CCJ – Strength Already Priced In

Cameco remains a core holding in the space, but it’s already rallied significantly and now trades near overbought levels. The technicals are strong—but not offering the best risk/reward for new capital this round.U.U – No Added Alpha

These physically-backed funds are excellent uranium proxies—but they do exactly what they say: track the spot price. That’s helpful for defensive positioning, but we’re looking for instruments with greater upside elasticity this month.

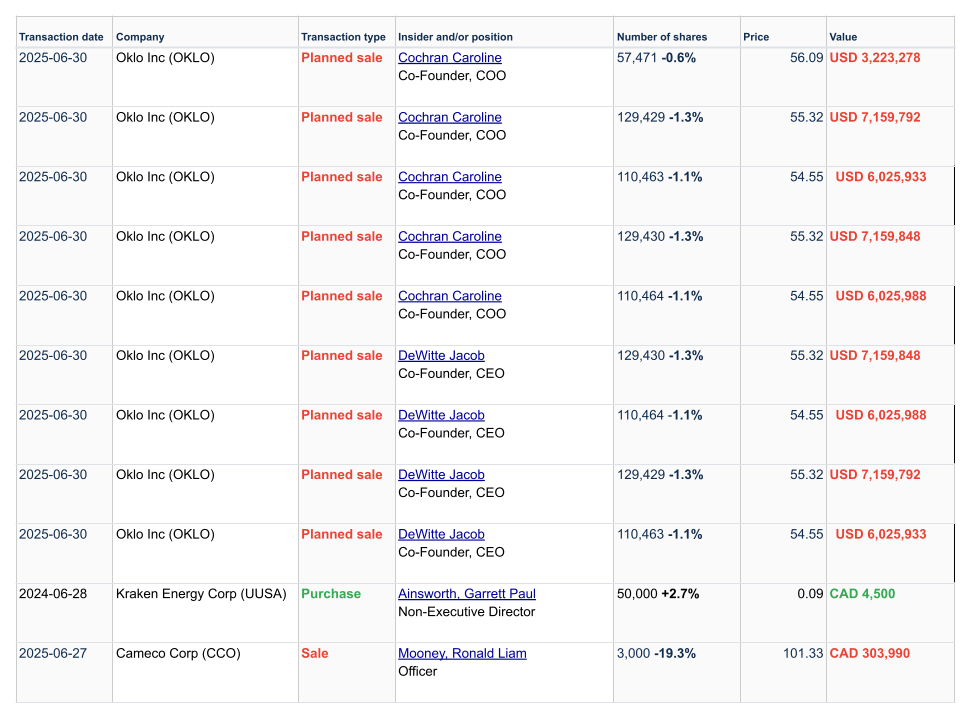

📬 Insider Transaction Action

Remember: Insiders might sell their shares for any number of reasons (divorce, buying property, diversification after a big run), but they buy them for only one: They think the price will rise.

Here’s this week’s action:

🗞️ This Week in Nuclear News

📈 Equity Ratings & Price Targets

Duke Energy (DUK) – Upgraded to 'Buy' by Goldman Sachs on stable yield, reinforcing utility sector confidence (price target $132.00)

Energy Fuels (UUUU) – Received a bullish upgrade from Canaccord Genuity, citing operational strength and rare earths upside (price target CAD 9.75)

Paladin Energy (PDN) Jefferies upgrades Paladin Energy Ltd to a Buy (price target of A$9.00.)

⚙️ Ops & Strategy

Dominion Energy (D) – Received 20-year license extension for V.C. Summer nuclear station

Western Uranium & Vanadium (WUC) – Announced AGM results and appointed new transfer agent as part of governance overhaul

Alligator Energy (AGE) – Appointed a new CEO effective July 1 to guide next phase of development

Nano Nuclear (NANO) – Facing shareholder investigation over potential misconduct, with legal pressure mounting

Energy Fuels (UUUU) – Reported continued operational outperformance at its Pinyon Plain uranium mine

Silex Systems (SLX) – Submitted full NRC license application for its U.S. enrichment plant, moving one step closer to commercial deployment

💰 Financing & M&A

Laramide Resources (LAM) – Launched a private placement to raise capital for ongoing uranium development ($10-Million Private Placement of Shares)

F3 Uranium (FUU) – Issued shares to settle interest on outstanding debt, improving near-term balance sheet (The payment consist of $225,000 in cash, and $112,499 in common shares)

Boss Energy (BOE) – Extended its uranium loan agreement with enCore; Barrenjoey also lifts long-term uranium price forecast

🔍 Sector Commentary

Uranium Sector – AI and hyperscaler-driven energy demand are reigniting investor interest in nuclear

ASX Uranium Names – Short interest remains elevated while several names feature in top movers list for Week 27

Global X Uranium ETF (URA) – Featured in clean energy stock roundup as investors rotate into nuclear amid AI-fueled demand growth

Global X Uranium ETF (URA) – Highlighted as 1 of 5 Sector ETFs that beat the Market in June

🎙️ Interviews & Market Talk

This week’s lineup starts with one of our own—Lucijan (@TriangleInvestor) sits down to talk uranium markets, macro triggers, and why patience pays in this sector. Plus: interviews with CEOs, analysts, and macro minds shaping the next leg of the energy transition.

📍 Global Atomic (GLO) – CEO Stephen Roman unpacks financing progress, DFC approvals, and how they’re managing Niger’s political risk—all while pushing ahead with uranium development.

👇 Watch the interview👇

📍 Chart Watch – Technical analyst Kasper Rasmussen walks through setups across silver, gold, uranium, and copper—and what’s signaling a breakout versus a breakdown.

👇Watch the analysis👇

📍 Macro Deep Dive – Henrik Zeberg breaks down recession risks, consumer behavior trends, and how central banks might fuel a gold and metals boom in the next phase of the cycle.

👇 Watch the conversation👇

📍 Sprott’s John Ciampaglia – Unpacks the White House’s nuclear push, spot market dynamics, and why institutional capital is circling uranium.

👉 Watch the interview

📍 Jimmy Connor x Per Jander – A focused breakdown of uranium spot market trends, utility demand, and why sentiment may be turning.

👉 Watch the interview

📍 Premier American Uranium – CEO Colin Healey breaks down the Nuclear Fuels acquisition, Wyoming-New Mexico drill strategy, and why the U.S. uranium revival is just getting started.

👉 Watch the interview

📍 UEC/UROY’s Scott Melbye unpacks Trump’s executive orders, Sprott’s buying spree, and why U.S. uranium momentum is accelerating into H2 2025.

👉 Watch the interview

📍 enCore Energy (EU) Executive Chairman William Sheriff details how enCore doubled uranium output to 3,700 lbs/day, slashed costs, and ramped ISR capacity across its U.S. operations.

👉 Watch the interview

⚛️That’s it for this week’s Nuclear Update Premium.

The macro backdrop is turning risk-on. Uranium’s steadying. And while utilities nap through summer, the setup for a second-half breakout is building.

We’ll keep tracking capital flows, insider moves, and sector inflection points as they unfold. In the meantime, let us know what you liked (or hated)—seriously, your feedback shapes what we cover next.

Thanks for reading, and we’ll see you next Saturday.

What did you think of this week's email? |

DISCLAIMER: We're not your financial advisor. This is for informational and educational purposes only. Always do your own research, and don’t make decisions based on internet strangers (even nuclear-obsessed ones like us). Nothing contained in this report should be construed as a recommendation to buy, sell, or hold any securities.

Reply